Delta’s old slogan has a much different feel to it, given the current pandemic. Delta used this saying back in 1968. It must have worked well, since they brought it back for an encore in 1984. Given travel dropped over 90% at the lows, Delta likely wants us to be […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

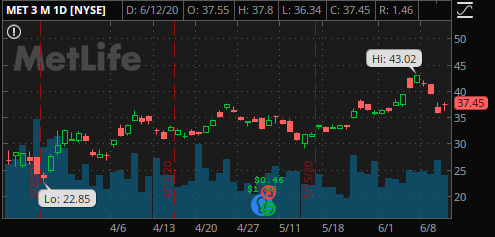

6/14/2020 Plan: This week we return to Metlife (Ticker: MET) 6/14/2020 Plan (continued): MET sell 17 Jul 30 put for 0.58 If you prefer to spread due to IRA restrictions or for margin purposes, 30/27.5 for 0.23 x2 Prices are as of market close 6/12/2020, actual fill and strikes may […]

In case you missed it, the market shot up almost 5% last week. With this big move, I had some shares of SPY called away on Friday (short call against long stock). This week we discuss a few ways to get right back into the market to position ourselves to […]

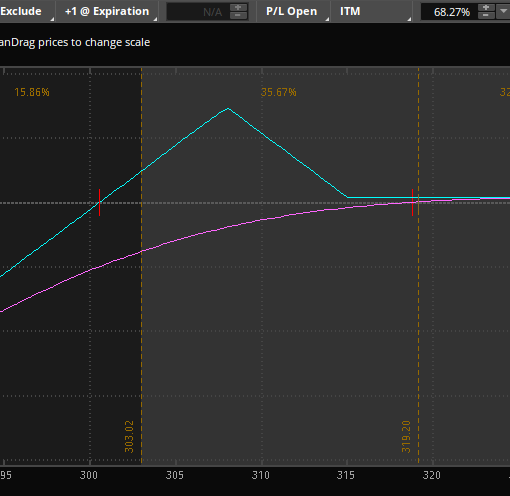

6/7/2020 Plan: This week we look at a couple different ways to play Disney (Ticker: DIS) 6/5/2020 Plan (continued): DIS sell 26 Jun 115/113 put spread x2 for 0.30 or DIS buy 17 July 120/115 1×2 puts for 0.80 credit if you want to get long DIS at lower prices […]

A scan of my portfolio shows many trades that are short volatility/long theta. The trades benefit from little movement and time passing. This works really well – until it doesn’t. Rather than Always selling options, I prefer to have a variety of volatility hedges (VIX, SPX butterflies, etc.). I also […]

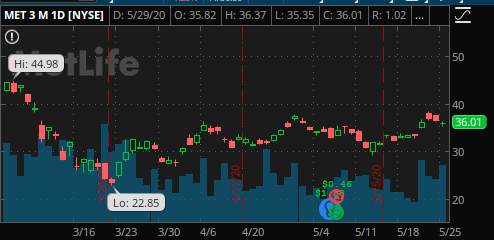

5/31/2020 Plan: This week we look at a neutral/bullish trade in Metlife (Ticker: MET) 5/31/2020 Plan (continued): MET sell 19 Jun 32 put for 0.38 If you prefer to spread due to IRA restrictions or for margin purposes, 32/30 for 0.20 x2 Prices are as of market close 5/29/2020, actual […]

I don’t actually have a Capital One (Ticker: COF) credit card in my wallet. I do have a debit card, though. I had my first online savings account with ING in the early 00s and Capital One bought them up back in 2011 for $9B. With this week’s trade, I’m […]

5/24/2020 Plan: Two ideas to consider this week. As a reminder, US markets are closed in honor of Memorial day on 5/25/2020 and re-open on Tuesday, 5/26/2020. 5/24/2020 Plan (continued): WBA 19 Jun sell 36.5/35 put spreads for 0.29 x3. C – 12 Jun – sell the 40/38 put spread […]

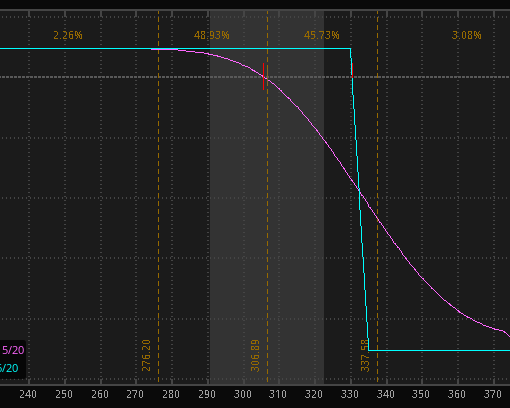

Simply put, betting against Apple is a bad idea. I’m going to recommend it anyway. 10 years ago Apple (Ticker: AAPL) was trading in the 30s. It is currently, as of 5/15/2020 above 300, up over 9 times while the broader market is up less than 3 times. Buying and […]

5/17/2020 Plan: Two ideas to consider this week – one bearish positions and one bullish. Pick one or the other, or both! 5/17/2020 Plan (continued): AAPL – 5 Jun- Sell 330/335 call spread for a 0.47 credit. JPM – 5 Jun – sell the 78/75 put spread for a 0.51 […]