5/10/2020 Plan: We had a nice result with a recent WBA trade and this week we put on a very similar one: 5/10/2020 Plan (continued): WBA- 22 May – Sell 39/37 put spread for a credit close to 0.30, two times. For a bit more risk, there is the 39.5/37 […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

In case you missed it, the market has been volatile for the last couple of months. Snap-On (ticker: SNA), a high-end tool maker, has been moving around quite a bit as well as the three month chart shows: While the stock has come up a lot off its lows, it […]

I work full time. I have a wife, two kids, and a mortgage. I have enjoyed investing and trading for many years (decades now that I think about it!), but have always needed to find a way to do it part time. Today, I explore some of the advantages to […]

I’ve taken zero Uber rides since COVID-19 began. How many have you taken? Prior to the crisis, I’ve used the service quite a bit, especially when on business travel. It is convenient and links up nicely with my expense reports. The company loses a lot of money, so while the […]

5/3/2020 Plan: A wild week last week and the end result was the market was close to unchanged (down 0.2%)! Two very different trade ideas this week to consider. One will use most of our buying power and another is a rinse and repeat trade that closed this past Friday […]

This week, we look at a little known company that supplies a key component in your cell phone. We don’t usually think about who makes are screen, but Corning (Ticker: GLW) has been supplying the glass for many years for many manufacturers with their “Gorilla Glass” (not made with real […]

4/26/2020 Plan: Two trade ideas, one for more aggressive traders, one for more conservative. Volatility has continued to come down some as the market continues to grind higher. “Everyone” is expecting us to drop again, but the market has been resilient recently. 4/26/2020 Plan (continued): 4/27/2020 Entry: Unfortunately we did […]

Want to hear something crazy? The NASDAQ is actually Up on the year. That’s right, if you bought an ETF tracking the NASDAQ, like QQQ, on 12/31/2019 you are actually now profitable: Hard to believe given the plunge we saw from a mid Feb high of $237 all the way […]

4/19/2020 Plan: As strange as it seems, volatility has actually dropped over the last few weeks as we’ve had a nice multi-week move higher. Note, however, that volatility remains high on an absolute basis, with the VIX closing at 38.15 on Friday April 17th. This week, we look to sell […]

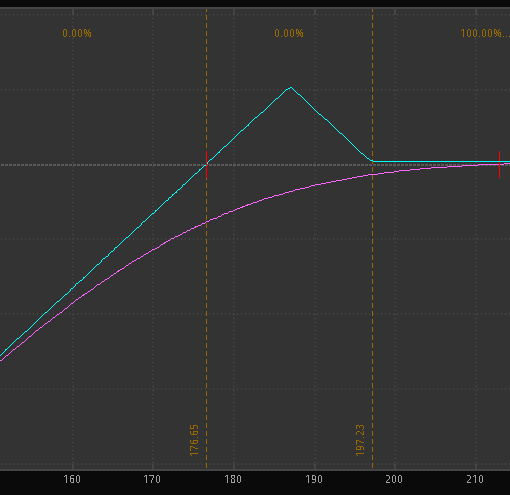

TAL Education Group (Ticker: TAL) For those not familiar, TAL is a holding company and its subsidiaries deal primarily with after school tutoring. China’s market has held up reasonably well, and if you believe the data, they are past the peak of COVID-19 cases. Trade Idea – Sell the 17 […]