4/12/2020 Plan: Two trade options this week, one for longer term DIS bulls and another more risky play for those traders looking for a quick potential win. 4/12/2020 Plan (continued): DIS Bulls – sell the 1 May 80 put for 0.64 at the midpoint. This is a 0.8% return for […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

4/5/2020 Plan: With many US States restricting travel, Uber (Ticker: UBER) volume is way down. Their Uber Eats service is likely way up, but with fierce competition, they are losing money on every delivery. While I do enjoy using the service, I have been bearish on Uber and Lyft. With […]

When was the last time you took an Uber? Probably before the pandemic… How about a Lyft? I don’t remember either. A clear number two in the ride sharing industry, with riding volumes down, and the recent rally slowing down, this is a reasonable time to put on some bearish […]

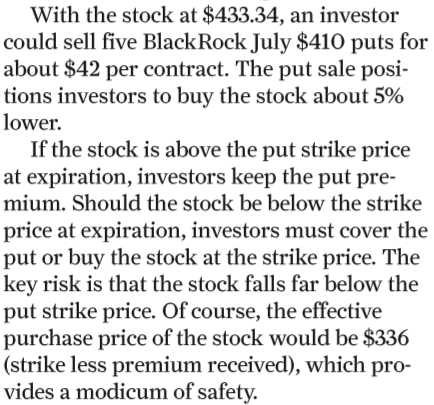

This is the fourth in an unexpected series of pointing out glaring errors in Barron’s. For some reason, the editorial quality has dropped off recently, leading to some pretty basic math errors being made and leading to confusion for new option traders. The 3/3/2020 recommends selling puts on BlackRock. A […]

3/29/2020 Plan: Volatility remains high with the market having multiple up days in a row last week. With much of the world staying home and many states ordered to do so, we plan a trade in Activision Blizzard (Ticker: ATVI), a name that should hold up well while more people […]

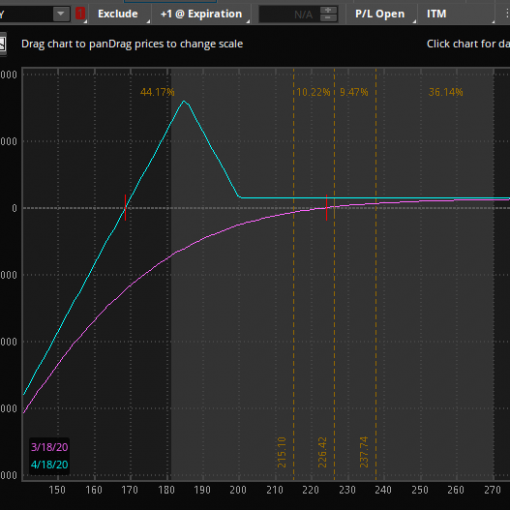

Limited time only! Everything must go! Generic marketing statement! As hard as it is to believe, the market was at all time highs closing on February 19th at 339.08. Here is a three month chart of SPY, showing that peak, plus our recent close of 228.02 on March 20th. It […]

3/22/2020 Plan: Volatility is still very high, but is just starting to come down from the peak. While predictions are always dangerous, we have likely already seen the high in VIX for this downturn. Just a little over a month ago, SPY topped out at 339.08. That seems like a […]

3/15/2020 Plan: Volatility remains very elevated, with circuit breakers being tripped in both the futures and daytime markets. There is no harm in sitting out the market another week, waiting for the markets to stabilize. For this week’s trade, we look at a name that should see some support as […]

I have written about selling puts on names that you might want to own for the long term as an investment. If you have extra cash in your account and want to own 100 more shares, writing (selling) puts is a great way to get in “on sale”. With the […]

Remember October 2014? We were all eagerly anticipating the upcoming release of Big Hero 6. OK, maybe not. What is interesting about Disney in 2014 is that it was the last time you could buy the stock for $85. Just one month ago, I wrapped up a Disney (Ticker: DIS) […]