6/28/2020 Plan: This week we look to sell a put spread in Walgreens Boots Alliance (Ticker: WBA) 6/28/2020 Plan (continued): WBA sell 17 Jul 37.5/35 put spread 2x for 0.32 Prices are as of market close 6/26/2020, actual fill and strikes may differ depending on Monday open, post will be […]

Monthly Archives: June 2020

2020 has been an … interesting year so far, to say the least. In the last year, the market is up 2.29% and year to date the market is down 6.86% [SPX as of 6/26/2020]. These nominal returns hide the fact that we are in the midst of a global […]

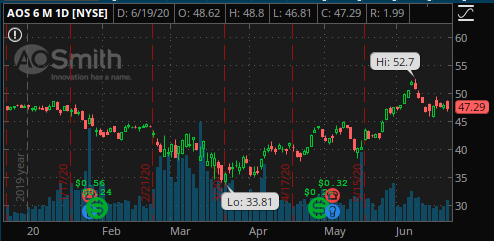

Let’s discuss a way to generate a bit of income on our long term stock holdings. This is a slight twist on the traditional covered call approach that I’ll be implementing on one of my underlyings in my long term portfolio. On Friday June 19th, I had some of my […]

6/21/2020 Plan: This week we look to sell a put in Capital One Financial (Ticker: COF) 6/21/2020 Plan (continued): COF sell 10 Jul 55 put for 0.77 (at the midpoint, the bid is 0.64) Prices are as of market close 6/19/2020, actual fill and strikes may differ depending on Monday […]

Delta’s old slogan has a much different feel to it, given the current pandemic. Delta used this saying back in 1968. It must have worked well, since they brought it back for an encore in 1984. Given travel dropped over 90% at the lows, Delta likely wants us to be […]

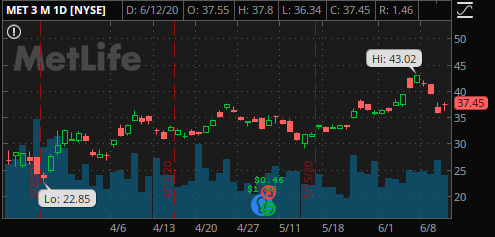

6/14/2020 Plan: This week we return to Metlife (Ticker: MET) 6/14/2020 Plan (continued): MET sell 17 Jul 30 put for 0.58 If you prefer to spread due to IRA restrictions or for margin purposes, 30/27.5 for 0.23 x2 Prices are as of market close 6/12/2020, actual fill and strikes may […]

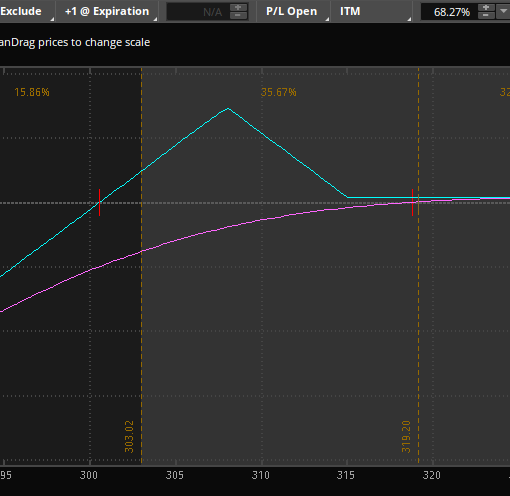

In case you missed it, the market shot up almost 5% last week. With this big move, I had some shares of SPY called away on Friday (short call against long stock). This week we discuss a few ways to get right back into the market to position ourselves to […]

6/7/2020 Plan: This week we look at a couple different ways to play Disney (Ticker: DIS) 6/5/2020 Plan (continued): DIS sell 26 Jun 115/113 put spread x2 for 0.30 or DIS buy 17 July 120/115 1×2 puts for 0.80 credit if you want to get long DIS at lower prices […]