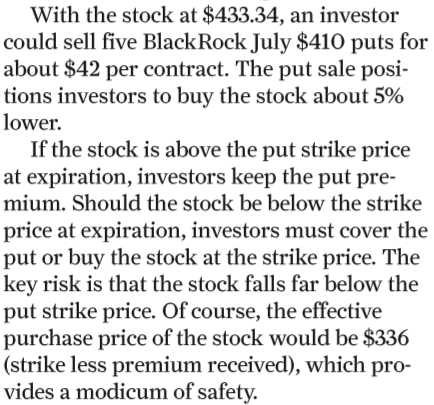

This is the fourth in an unexpected series of pointing out glaring errors in Barron’s. For some reason, the editorial quality has dropped off recently, leading to some pretty basic math errors being made and leading to confusion for new option traders. The 3/3/2020 recommends selling puts on BlackRock. A […]

Yearly Archives: 2020

3/29/2020 Plan: Volatility remains high with the market having multiple up days in a row last week. With much of the world staying home and many states ordered to do so, we plan a trade in Activision Blizzard (Ticker: ATVI), a name that should hold up well while more people […]

Limited time only! Everything must go! Generic marketing statement! As hard as it is to believe, the market was at all time highs closing on February 19th at 339.08. Here is a three month chart of SPY, showing that peak, plus our recent close of 228.02 on March 20th. It […]

3/22/2020 Plan: Volatility is still very high, but is just starting to come down from the peak. While predictions are always dangerous, we have likely already seen the high in VIX for this downturn. Just a little over a month ago, SPY topped out at 339.08. That seems like a […]

3/15/2020 Plan: Volatility remains very elevated, with circuit breakers being tripped in both the futures and daytime markets. There is no harm in sitting out the market another week, waiting for the markets to stabilize. For this week’s trade, we look at a name that should see some support as […]

I have written about selling puts on names that you might want to own for the long term as an investment. If you have extra cash in your account and want to own 100 more shares, writing (selling) puts is a great way to get in “on sale”. With the […]

Remember October 2014? We were all eagerly anticipating the upcoming release of Big Hero 6. OK, maybe not. What is interesting about Disney in 2014 is that it was the last time you could buy the stock for $85. Just one month ago, I wrapped up a Disney (Ticker: DIS) […]

3/8/2020 Plan: We are still in the midst of a high volatility regime, with the VIX closing at 41.94 last Friday 3/6/2020 and the march VIX future up to 36.10. There is no harm in sitting out the market this week, waiting for the markets to stabilize. This week’s trade […]

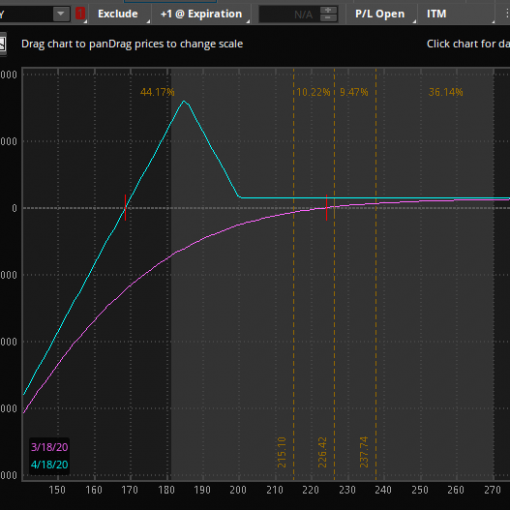

When people refer to volatile markets, they often mean the market has dropped. The truth is that volatility is direction agnostic. While puts certainly can increase tremendously in value with the increase in implied volatility as markets plummet, we can see an increase in IV in the calls as well. […]

Yes I am using a motivational phrase produced by the British Government to talk about the US stock market. Last week’s market action, which may have Felt like a World War II air raid was not fatal nor as serious. The chart isn’t pretty, though, with the market dropping ~11.5% […]